With the new Feebate scheme, kiwi car buyers are confused about whether they will get money back or an extra bill when they buy a new car. So, let’s clear up a few things from the information we’ve been given so far.

The introduction of New Zealand’s “Clean Car Programme” hit the headlines in 2021. It is positive news for anyone buying an Electric Vehicle. But for farmers, or anyone who loves a ute, they’re about to be stung with a tax levied against vehicles considered to be highly polluting.

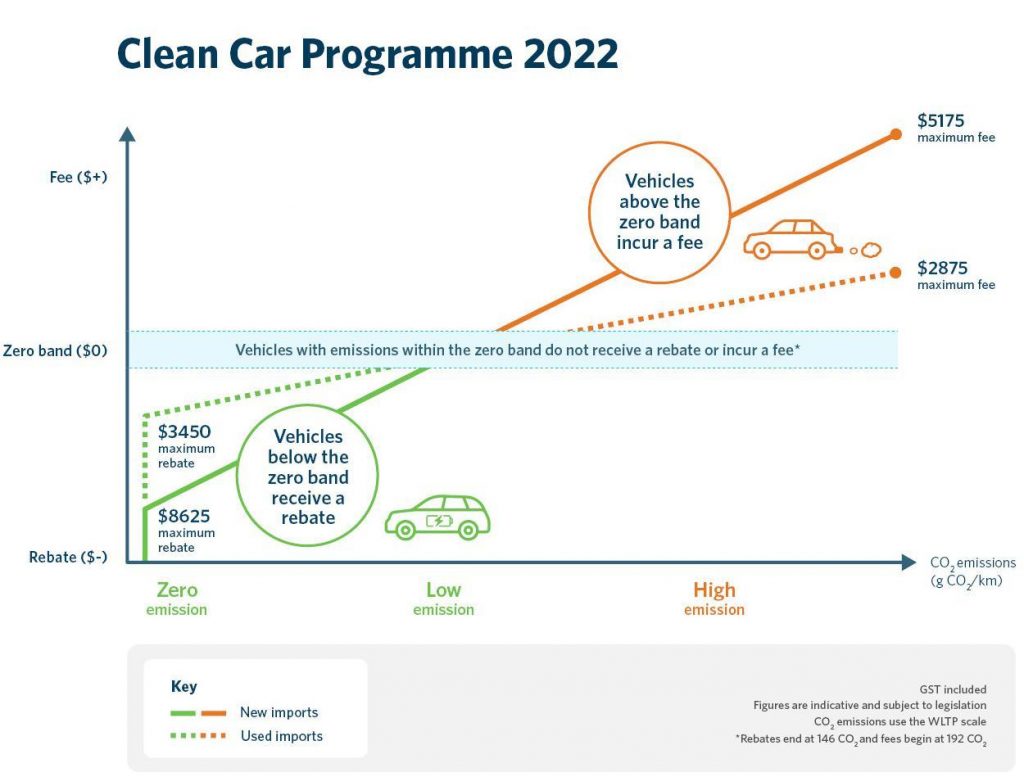

In theory, the scheme is supposed to be self-funding. When a levy for a high-polluting car, truck or van gets paid, it goes into the ‘pot’. When someone buys an EV that is non-polluting, they can get a rebate paid out of that ‘pot’.

Additional levies may potentially put thousands of dollars onto a ute’s price tag. While rebates potentially remove thousands of dollars off an EV. So, how can you make sure that the vehicle you’re buying isn’t going to cost you extra?

Which Cars Get A Rebate

Because the legislation is still being processed, at this stage, we are only able to tell you which vehicles in 2021 are eligible for a rebate. We’ll keep you updated as more information comes to hand, but so far, the NZTA has said:

- A new imported light battery electric vehicle (BEV); or

- A used imported light battery electric vehicle (BEV); or

- A new imported light plug-in hybrid electric vehicle (PHEV); or

- A used imported light plug-in hybrid electric vehicle (PHEV).

Before 31 December 2021, any used vehicle that meets the criteria could get a rebate of up to $3450. After 2021 it seems that you will not be able to get the rebate retrospectively.

Which Cars Pay An Extra Levy

It’s all based on carbon emissions. So, the more CO2 the truck puts out, the higher the fee will be. Believe it or not, the government actually expects to see a massive spike in people buying utes and high polluting vehicles before the legislation comes into effect. They’re working on the long game. So while it’s being dubbed the “bugger of a tax” (for those old enough to remember the late 1990s Toyota ad that made “bugger” a perfectly good word to use… and thank you Barry Crump and Lloyd Scott for getting that ball rolling), it should find itself phased out as less high-pollution vehicles come into the country.

Official “exemptions to the clean car standard”, according to the current NZTA updates, include:

- agricultural vehicles for farms, such as tractors, harvesters, mowers, toppers, bailers

- military vehicles

- special interest vehicles

- vintage and veteran vehicles

- scratch built vehicles and modified cars certified by the Low Volume Vehicle Technical Association Incorporated.

Luxury Cars Don’t Get Rebates

To get a rebate, the car has to be under $80,000 – there may be some room to move as far as accessories go, but the NZTA has a pretty good idea of what new cars are selling at.

What we don’t know is if your $120,000 Land Rover will get a levy added – sadly, you should assume so.

Buying A Car Through Online Traders

The NZ Clean Car legislation only affects cars when they are first registered in New Zealand. So, buying a car from a private seller shouldn’t make a difference to your purchase price. For example, most of the cars sold privately via Shopless have been registered in New Zealand before the legislation came into effect.

Buying a Deregistered Car

As long as the vehicle has at some stage been registered in New Zealand, you don’t have to worry about being stung with an extra levy when you register. Sadly, this also means that you can get a rebate if you’re buying a deregistered EV. The new rules only apply when a car is first registered in New Zealand.

You will need to go through the usual process of getting the car re-registered, potentially including new plates etc., as you usually would. If the vehicle has never been registered in New Zealand, then yes, you will be liable for any levy payable.

Buying a NoWOF/NoReg Car

Any vehicle in New Zealand has to have current registration and Warrant Of Fitness before being legally allowed to be driven on our roads. If you’re buying the car as a “paddock bash”, this probably isn’t a big deal, but most of us want to be able to use our vehicles! You can check that the details on the car are accurate via the NZTA website.

This can also tell you when the car was first registered, so you can ensure that you won’t be hit with unexpected fees when you get to register your vehicle.

Paying the levy

As of 1 January 2022, you will need to pay any applicable levies to Waka Kotahi NZ Transport Agency (NZTA) when you register a car. The amount you pay will be based on the carbon emissions, and you can check with the government website RightCar. This gives you information about the rating for carbon emissions and information about the safety rating on the car.

Avoiding Car Taxes and Rip-Offs

At the end of the day, we all know that the government will always find new and interesting ways to get money out of us. It’s how the country functions, and there will always be winners and losers. However, with the increase of low-polluting vehicles available globally, most people should be able to change when they next upgrade their cars.

Remember, this legislation update only affects cars, vans, or trucks registered for the first time in New Zealand. This means that vehicles you buy second-hand are generally not going to be an issue at all. Shop safe, check the buyer is who they say they are, check the rego matches, and have a trusted mechanic complete a pre-purchase inspection where you can.

Pingback: Are Electric Cars Really That Green? - Shopless blog

Pingback: Will Electric Cars Take Over Petrol Cars with Pending Government Ban?